"Mr. FiSTer of Team FiST Fetish" (mrfist)

"Mr. FiSTer of Team FiST Fetish" (mrfist)

04/18/2018 at 17:45 ē Filed to: None

6

6

26

26

"Mr. FiSTer of Team FiST Fetish" (mrfist)

"Mr. FiSTer of Team FiST Fetish" (mrfist)

04/18/2018 at 17:45 ē Filed to: None |  6 6

|  26 26 |

I was transferring some money around and thought, ďhuh, I should have more than thatĒ. Go through and find $922 worth of iTunes charges that donít belong to me. Bank has been contacted and they are disputing the charges and sending a new card. Fucking crazy.

KingT- 60% of the time, it works every time

> Mr. FiSTer of Team FiST Fetish

KingT- 60% of the time, it works every time

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 17:51 |

|

What would I check my bank accounts for? Money I donít have?

Otto-the-Croatian-'Whoops my Volvo is a sedan'

> Mr. FiSTer of Team FiST Fetish

Otto-the-Croatian-'Whoops my Volvo is a sedan'

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 17:51 |

|

Iím glad you got off the hook for it. Do you know what did they get on iTunes?

Mr. FiSTer of Team FiST Fetish

> Otto-the-Croatian-'Whoops my Volvo is a sedan'

Mr. FiSTer of Team FiST Fetish

> Otto-the-Croatian-'Whoops my Volvo is a sedan'

04/18/2018 at 17:53 |

|

No idea, I didnít know you could spend that much on iTunes that quickly.

Sampsonite24-Earth's Least Likeliest Hero

> KingT- 60% of the time, it works every time

Sampsonite24-Earth's Least Likeliest Hero

> KingT- 60% of the time, it works every time

04/18/2018 at 17:55 |

|

even less money you dont have

winterlegacy, here 'till the end

> Mr. FiSTer of Team FiST Fetish

winterlegacy, here 'till the end

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 17:56 |

|

Buy all of the music, movies, and shitty shovelware games.

SPAMBot - Horse Doctor

> Mr. FiSTer of Team FiST Fetish

SPAMBot - Horse Doctor

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 18:14 |

|

This happened to me on my credit card. Noticed my $4.99 Pandora came out earlier than usual but didnít think twice. Then, next thing I know my CC company texts, asking if I mad a $35 iTunes purchase. I got it shut down immediately after that and they sent a new card. Still a PITA, but at least it wasnít a debt card where my money was actually tied up while I disputed the charges.

Mr. FiSTer of Team FiST Fetish

> SPAMBot - Horse Doctor

Mr. FiSTer of Team FiST Fetish

> SPAMBot - Horse Doctor

04/18/2018 at 18:21 |

|

They got my debit card which is just awesome. Iíll just be using credit for the next few days.

Scary__goongala!

> Mr. FiSTer of Team FiST Fetish

Scary__goongala!

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 18:22 |

|

Last year someone made 3 separate $98 purchases at Tim hortonís in Ohio plus a $10 buss pass in Mass. with my info. Meanwhile Iím at school in WV. Thankfully got all my money back but had to go thru that annoying process of resetting everything

C62030

> Mr. FiSTer of Team FiST Fetish

C62030

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 18:27 |

|

Complete U2 discography. That free one got them hooked.

Eric @ opposite-lock.com

> Mr. FiSTer of Team FiST Fetish

Eric @ opposite-lock.com

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 18:32 |

|

If you used CCs for all purchases to begin with instead of your debit card, this would be less of a problem...

SPAMBot - Horse Doctor

> Mr. FiSTer of Team FiST Fetish

SPAMBot - Horse Doctor

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 18:44 |

|

Yikes! Hopefully the bank resolves it quickly!

diplodicus forgot his password

> Eric @ opposite-lock.com

diplodicus forgot his password

> Eric @ opposite-lock.com

04/18/2018 at 19:11 |

|

My only problem with that is that if I use my credit card too much my credit score goes down.

interstate366, now In The Industry

> Mr. FiSTer of Team FiST Fetish

interstate366, now In The Industry

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 19:38 |

|

Happened to me twice last year. I didnít even do anything out of the ordinary.

AestheticsInMotion

> Scary__goongala!

AestheticsInMotion

> Scary__goongala!

04/18/2018 at 20:12 |

|

Sorry I was hungry

Tristan

> Mr. FiSTer of Team FiST Fetish

Tristan

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 20:25 |

|

Last summer I spent $3700 in Vietnam while I was sleeping in my Las Vegas hotel room... I feel your pain.

bubblestheturtle

> Mr. FiSTer of Team FiST Fetish

bubblestheturtle

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 20:33 |

|

Yea, I had someone buy a Jeep Cherokee with my CC, through PayPal. PayPal was all over it when I called them to dispute, but still...crazy.

Scary__goongala!

> AestheticsInMotion

Scary__goongala!

> AestheticsInMotion

04/18/2018 at 21:03 |

|

Nobody needs that many bagels and coffee!!

AestheticsInMotion

> Scary__goongala!

AestheticsInMotion

> Scary__goongala!

04/18/2018 at 21:08 |

|

You donít know my life!

Rico

> Mr. FiSTer of Team FiST Fetish

Rico

> Mr. FiSTer of Team FiST Fetish

04/18/2018 at 21:17 |

|

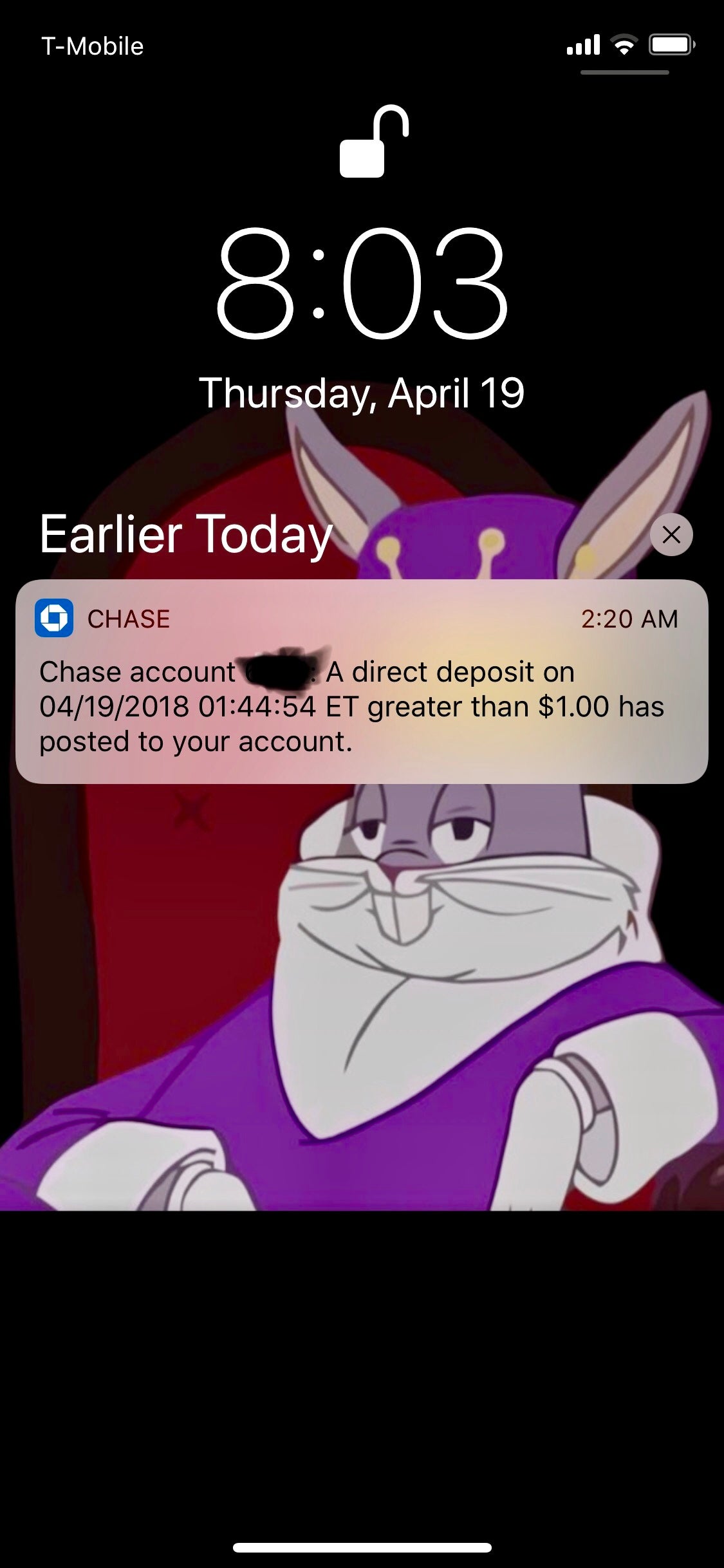

Does your bank offer you alerts? I have alerts on my Chase account that covers my Chase credit cards. If any amount over $1 goes in or out of any account (checking, savings, credit card) I get a push alert on my iPhone. Itís nearly instant whenever I swipe my card to pay for anything or run my card online to pay.

Rico

> Eric @ opposite-lock.com

Rico

> Eric @ opposite-lock.com

04/18/2018 at 21:18 |

|

That buffer is extremely important!

Mr. FiSTer of Team FiST Fetish

> Rico

Mr. FiSTer of Team FiST Fetish

> Rico

04/18/2018 at 21:25 |

|

I donít know that it does but Iíll look into it, thanks!

Mr. FiSTer of Team FiST Fetish

> Eric @ opposite-lock.com

Mr. FiSTer of Team FiST Fetish

> Eric @ opposite-lock.com

04/18/2018 at 21:25 |

|

Thanks, Eric.

Eric @ opposite-lock.com

> diplodicus forgot his password

Eric @ opposite-lock.com

> diplodicus forgot his password

04/18/2018 at 22:44 |

|

Why?

Mine doesnít. Just pay them off, just like you only spend what you have in your bank account with a debit card.

If you want to keep your utilization low, check your credit report with some credit check site and pay the respective card ~3-5 business days before the reporting date each month.

Eric @ opposite-lock.com

> Rico

Eric @ opposite-lock.com

> Rico

04/18/2018 at 22:44 |

|

Please elaborate.

Rico

> Eric @ opposite-lock.com

Rico

> Eric @ opposite-lock.com

04/19/2018 at 08:01 |

|

Basically adding onto what you said. Credit cards are a good buffer between a purchase and your actual money. So if something goes wrong like a fraudulent charge your actual money is still protected vs. a debit card where your money is in jeopardy.

A CC company can reverse a charge within 24 hours (as you know) but the bank will not instantly refund your checking account if you claim a fraudulent charge, they need to do a bunch of things that end up delaying the return of your money sometimes by a few weeks.

So if somebody runs up a $1,000 in debit card transactions, you might not get that money back for a while and that might complicate things if you are tight on money or needed it for bills.

Rico

> Mr. FiSTer of Team FiST Fetish

Rico

> Mr. FiSTer of Team FiST Fetish

04/19/2018 at 08:05 |

|

Hereís what it looks like on my phone.